Will halal financing save the Gulf?

While low oil prices continue to press hard on Gulf states' coffers, governments are looking for new ways to raise taxes.

The IMF's Christine Lagarde, who has been in the oil-and-gas rich state of Qatar this weekend, has repeatedly called for Gulf countries to adopt far-reaching economic reforms and aim for more frugal budgets.

|

| [Click to enlarge] |

Tightening belts will be difficult for many in the Gulf after seeing secure jobs created, wages rise and numerous government handouts after a decade of high oil prices.

But like a sensible but persistent parent, Lagarde seemed to press on the GCC states again during her meeting that there must be a "mature" approach to government spending, or serious repurcussions could arise in the near future.

One alarmist IMF report suggested that Saudi Arabia could effectively go "bankrupt" in five years' time, unless it takes the matter seriously.

Falling oil prices are said to have amounted to losses of $360 billion this year, and there is a fear that Riyadh's price war with shale oil producers in the US could do irreversible damage to the country.

Saudi Arabia's real war in Yemen could also cost the country dearly - as much as $675 million a month.

This is part of the reason that Saudi Arabia is expected to notch up a huge deficit of 16 percent of gross domestic product in 2014 after years in the black.

Obviously, breaking spending habits will be hard for many citizens of the Gulf. Governments such as Riyadh's will know that they risk seriously rattling their population if and when they make spending cuts.

"Almost every week we hear about Kuwait giving grants left, right and centre to other nations that are in need of money. It's as if the government doesn't realise that we, in Kuwait, are also in need," Abdulaziz Al-Adwani, a Kuwaiti school teacher, told AFP.

|

| [Click to enlarge] |

Many citizens who work in middle and working class jobs are fearful that taxes will eat into their salaries that are becoming increasingly meagre compared with rising costs.

Cutting subsidies on gas, oil and staple foods could be another hurdle for the governments.

These essentially cushion the high-cost of life in the Gulf for lower-paid subjects - whether teachers in Kuwait, taxi drivers in Oman or police in Saudi Arabia.

Oman's shura council parliament has tried to resist subsidy cuts and new taxes.

Shrinking the state - ie: sacking lower-paid public sector workers filling roles that might be deemed unnecessary such as drivers and clerks - is another fear of Gulf nationals.

Despite objections to spending cuts which are widely heard in the Gulf, Largarde seems persistent in her view that some of these "government services" will have to go.

"The main elements are common across countries: an expansion of non-oil tax revenues; raising energy prices, which are still well below international norms; firm control of current spending, particularly on public sector wages; and a review of capital expenditures," the IMF said in a statement.

What might save the day are "sukuk" Islamic bonds, and Gulf countries have been eager to shore up funds through such schemes.

|

| [Click to enlarge] |

Oman's debut sovereign sukuk opened for subscription in October and is seen as one way of avoiding debt for the country hit hard by low oil prices.

Indeed, halal forms of financing have been used in the past as a way of Muslim-majority countries of accessing new funds.

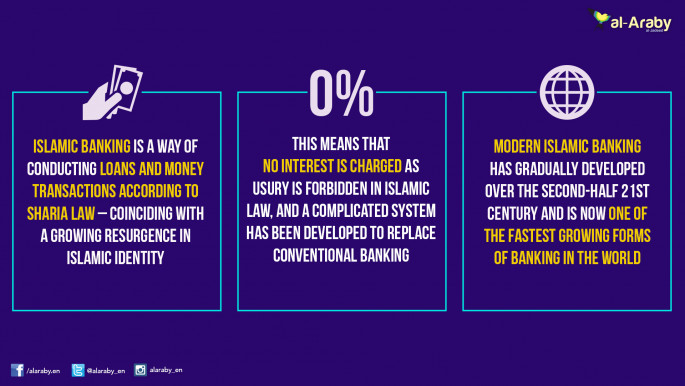

Islamic banking is also viewed as an increasingly attractive alternative for many in the Gulf, and viewed as a more ethical way of obtaining loans.

Assets from Islamic financial assets have reached $2 trillion, but low oil prices could also threaten the growth of this industry which has stayed around 10 to 15 percent for the past decade.

Standard and Poor's predicts regional growth to fall to single digits in 2016.

The question of what steps can be taken to revive the industry will no doubt take prominence during the World Islamic Banking Conference due to be held in Manama, Bahrain, in early December.

What was once touted as the future of banking now looks tied to oil prices and the economic resilience of the Gulf states' economies.

![Minnesota Tim Walz is working to court Muslim voters. [Getty]](/sites/default/files/styles/image_684x385/public/2169747529.jpeg?h=a5f2f23a&itok=b63Wif2V)