Egypt shuts down half of country's currency exchange kiosks

Egypt's central bank has closed half of the country's currency exchange bureaus in a bid to regulate the market amid a severe foreign currency shortage.

At least 47 out of a total of 94 licensed currency exchange bureaus in the country have been shut down so far, an anonymous source told state-run news agency.

Twenty-six of the currency exchange bureaus have been closed permanently and had their licences revoked.

The rest face temporary suspension for periods ranging from six months to a year, depending on their violations.

The decision came after the bureaus were found guilty of manipulating and speculating on the prices of foreign currencies in the country's parallel currency market, according to local media.

In June, the cabinet approved prison sentences for individuals breaking the foreign exchange law, with jail terms ranging from six months to three years and fines ranging from one to five million Egyptian pounds ($112,608 - $563,044).

The cabinet also granted the central bank governor the power to suspend any exchange bureau's licence for a year in case of any infraction and to impose a similar fine. Repeat offenders can have their licences permanently revoked.

Dollar deficit

Egypt has been suffering from a shortage in foreign currencies, particularly the US dollar. Usual sources of hard currency - such as from tourism and foreign investment - have significantly slowed due to political and economic instability.

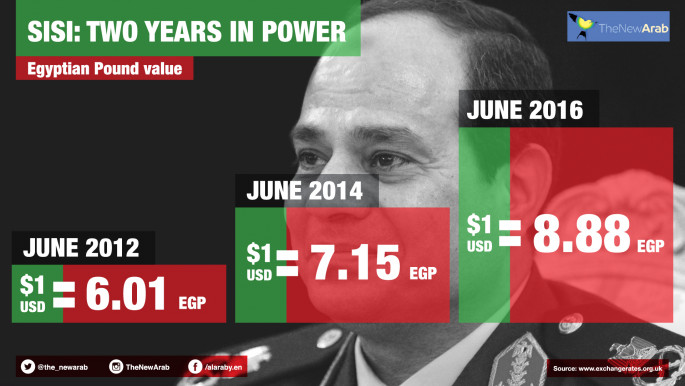

The economic crisis has led to an unprecedented dollar deficit, with the Egyptian pound trading at up to 13 to the dollar in the black market, compared with the official rate of about 8.8.

|

| [Click to enlarge] |

However, the value of the Egyptian pound was recently strengthened to a range between 12.40 - 12.70 after the government announced in July that it was negotiating with the International Monetary Fund (IMF) to secure a $12 billion loan.

In March, the central bank devalued the pound by 13 percent in March in an effort to close the gap between the official and parallel rates. But the devaluation and easing restrictions on the transfer and deposit of foreign currency failed to boost dollar liquidity enough to eradicate the black market.

Reserves fell 18.1 percent from June to December, shrinking to $16.5 billion, before edging up to $17.546 at the end of June, according to central bank data.

Egypt had $36 billion in reserves before the 2011 uprising.

Economic policies

On Saturday, Egyptian President Abdel Fattah al-Sisi defiantly dismissed criticism of his handling of the country's ailing economy.

In comments marking the first anniversary of the inauguration of the expansion of the Suez Canal, Sisi acknowledged that the Egyptian pound's value was falling against the US dollar and that prices were soaring.

But returned to his oft-repeated assertion that the achievements under his stewardship would normally have taken 10-15 years to accomplish.

His latest comments were his most detailed on the growing criticism of his economic policies, particularly the feasibility of the massive and costly projects he has opted to launch since his June 2014 election.

These include the Suez Canal expansion, reclaiming 1.5 million acres of desert, a nationwide network of roads, a new capital, and the construction of cheap housing.

Critics contend that the projects have not been sufficiently studied, stretched the country's already shaky finances, and drained resources from more pressing areas.

![President Pezeshkian has denounced Israel's attacks on Lebanon [Getty]](/sites/default/files/styles/image_684x385/public/2173482924.jpeg?h=a5f2f23a&itok=q3evVtko)

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News