US Congress probes PGA-LIV golf merger involving Saudi money

The US Congress launched a probe on Monday into the surprise merger of the PGA Tour with Saudi-backed LIV Golf, the chair of an investigative panel announced.

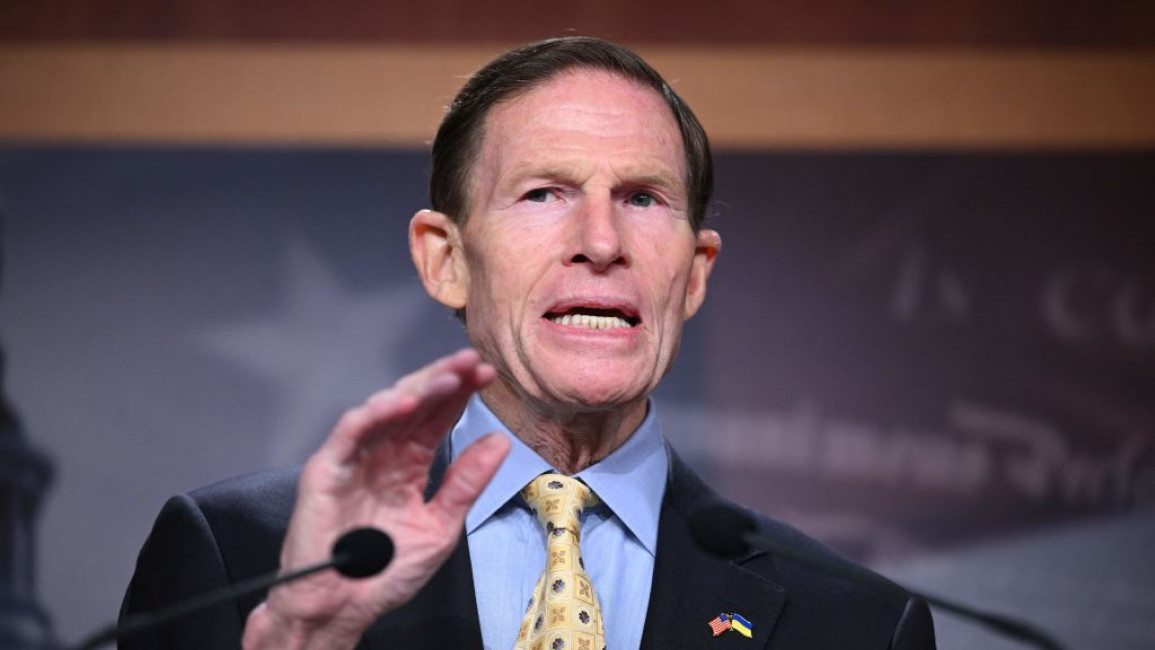

The deal unveiled last week raises questions about the role of the Saudi government in the accord, said Senator Richard Blumenthal, chairman of the Senate Permanent Subcommittee on Investigations.

The merger settled a legal battle between the rival tours only a year after LIV Golf launched with several stars who had jumped from the PGA for big-money offers from the upstart series.

LIV Golf was launched in October 2021 and lured top PGA Tour talent with record $25-million purses and money guarantees, bankrolled by Saudi Arabia's Public Investment Fund (PIF).

Critics said LIV was conceived by the kingdom as a "sportswashing" exercise designed to improve Saudi Arabia's international image, battered after the 2018 murder of dissident journalist Jamal Khashoggi.

In letters to PGA Tour and LIV Golf, Blumenthal said Saudi Arabia had a "deeply disturbing human rights record at home and abroad" and aimed to "use investments in sports to further the Saudi government's strategic objectives".

Blumenthal cited what he called "the risks posed by a foreign government entity assuming control over a cherished American institution".

He asked for documentation from the PGA and LIV on the merger by 26 June.

The golf deal came as Saudi Arabia chalked up another coup in the sports world, with its football team Al-Ittihad signing the French star Karim Benzema to a three-year deal believed to be worth hundreds of millions of dollars.