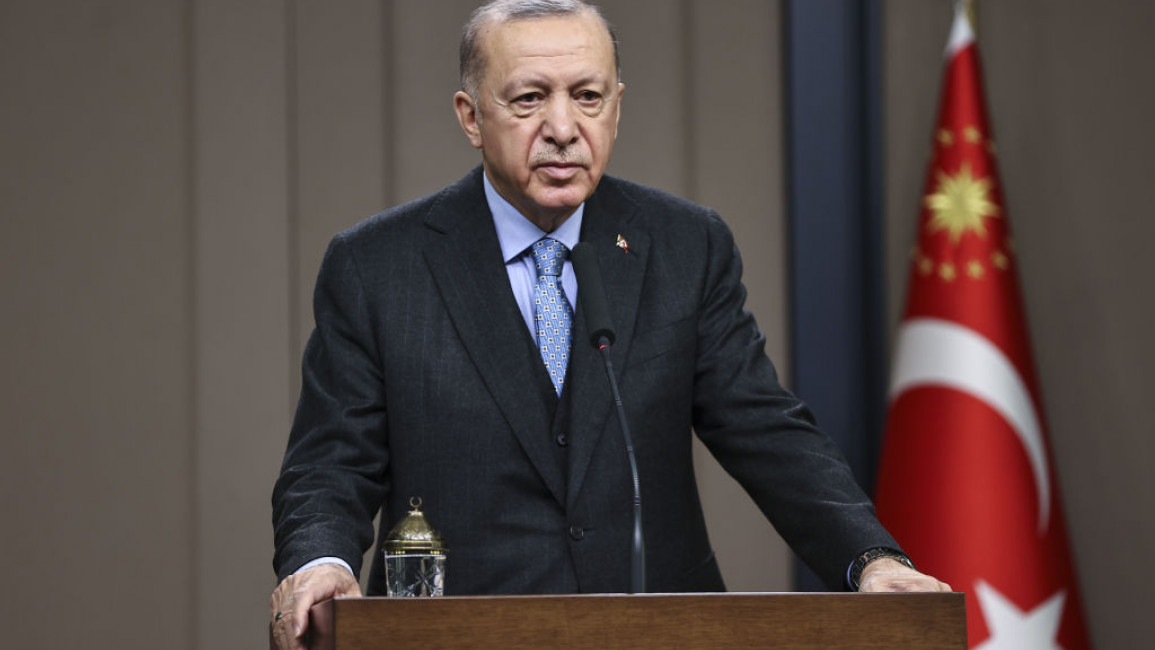

Turkey inflation highest since 2002 as Erdogan continues 'fight against interest rates'

Turkey's annual inflation rate in January reached its highest level since April 2002, official data showed on Thursday, after a currency crisis decimated people's purchasing power.

Consumer prices surged by a stronger-than-expected 48.7 percent from the same period in January last year, up from an annual rate of 36.1 percent in December, according to the Turkish statistics agency.

The reading came out just days after President Recep Tayyip Erdogan changed the head of the state statistics agency for the fourth time since 2019.

Turkish media reported that Erdogan was unhappy with agency data showing inflation reaching the highest level since his Islamic-rooted party stormed to power two decades ago, complicating his path to re-election in 2023.

Former agency chief Erdal Dincer had only been in the job for 10 months. He was replaced by Erhan Cetinkaya, who was vice-chair of Turkey's banking regulator.

Independent data collected by Turkish economists suggested that the annual rate of inflation rose to more than 110 percent in January.

Erdogan staunchly opposes raising interest rates, which he believes cause inflation - the exact opposition of conventional economic thinking.

He admitted on Monday that Turks would "have to carry the burden" of inflation for "some time".

"God willing we have entered a period where each month is better than the previous one," he added.

Turkey has suffered from persistently high inflation for years, experiencing two currency crises since 2018.

The second last year came after Erdogan orchestrated sharp interest rate cuts that put them far below the rate at which prices were rising, eroding Turks' purchasing power and the value of their savings.

This prompted Turks to stock up on gold and foreign currency, resulting in a currency crash that saw the lira lose 44 percent of its value against the dollar in 2021.

'Fight against interest rates'

Turkish Finance Minister Nureddin Nebati told Nikkei Asia in an interview published on Thursday that inflation would peak in April before falling to the single digits by the June 2023 general election.

The central bank last month also revised up its forecast for inflation at the end of 2022 to 23.2 percent from 11.8 percent, although most economists dismiss the reading as overly optimistic.

"We expect inflation to hover at 45-50% throughout much of this year and, barring another collapse in the lira, it will only drop back in the final months of 2022," said analyst Jason Tuvey of Capital Economics.

The government hopes that inflation will fall after pressures - including a minimum wage hike in January and rising energy bills for households and businesses - subside and new currency support measures kick in.

The central bank paused a four-month streak of interest rate cuts in January, providing relief for lira, which has held largely steady this year.

Critics said it was another bid to crack down on freedom of speech in the run-up to elections next year. 🗳 https://t.co/Z2AkywaAgx

— The New Arab (@The_NewArab) January 30, 2022

But at the weekend, Erdogan once again refused to accept conventional thinking that says high borrowing costs help bring down consumer prices by limiting demand and slowing economic activity.

"You know my fight against interest rates," he said.

"We're going to bring down the rate and we are reducing the rate. Know that inflation will fall - it will fall further."

Erdogan cites Islamic rules against usury while promoting an "economic war of independence" designed to break Turkey's reliance on foreign currency inflows.

But economists point out that Turkey still needs dollars to pay for energy and other imports, which become more expensive as the value of the lira drops.