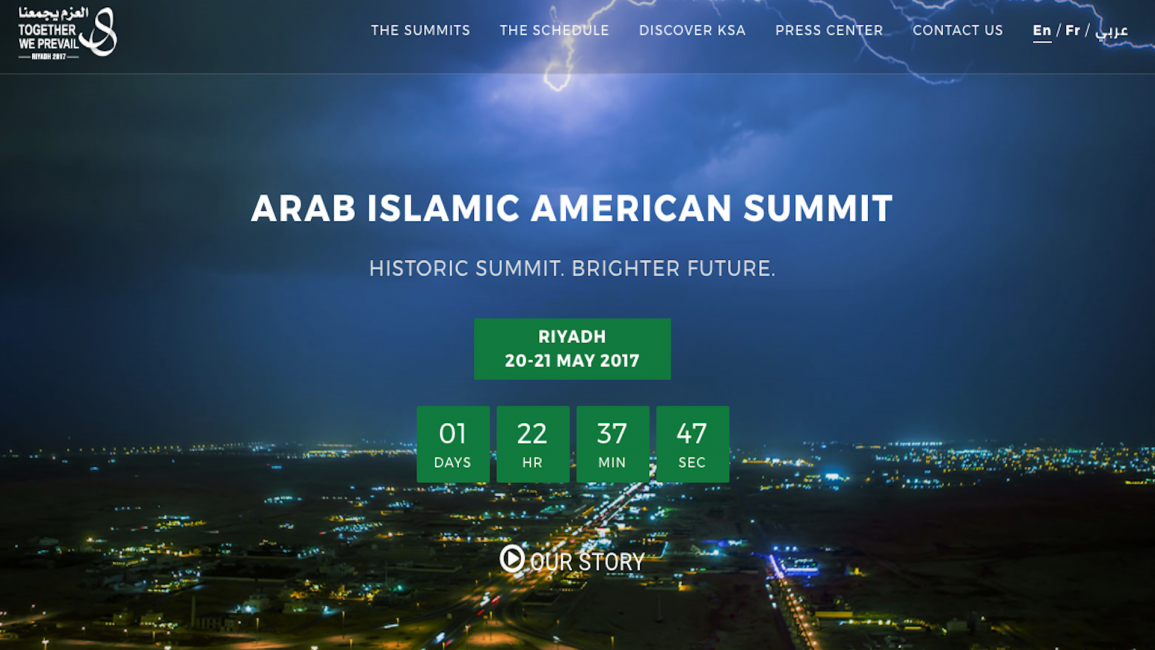

Saudi Arabia counting down the seconds until Trump arrives

The kingdom has launched a website, the official page riyadhsummit2017.org, in four languages with a countdown clock and details about the visit, which is packed with meetings.

After meeting King Salman on Saturday, Trump is scheduled to take part Sunday in a pan-Arab and Islamic summit with leaders from across the Middle East, Africa and Asia.

He is also scheduled to hold a separate joint session with the Arab rulers of Saudi Arabia, the United Arab Emirates, Qatar, Kuwait, Oman and Bahrain.

Coinciding with the visit is a business forum Saturday in Riyadh with CEOs from companies like GE and Dow Chemical.

Saudi Arabia will wants to showcase high-profile investment deals with American companies to show progress on its “Vision 2030” economic and social reform agenda, while Washington says US arms sales arms worth tens of billions of dollars are in the pipeline.

|

Several deals are expected to be signed in defence, electricity, oil and gas, industrial and chemical sectors. New licenses for US companies to operate in the kingdom also will be issued. |  |

It's business

Several deals are expected to be signed in defence, electricity, oil and gas, industrial and chemical sectors. New licenses for US companies to operate in the kingdom also will be issued.

The CEO of state oil giant Saudi Aramco is expected to sign deals with top US companies to promote local manufacturing.

General Electric Co. is due to sign several memoranda of understanding, according to Reuters. Saudi Basic Industries Corp. and US oil company ExxonMobil Corp. are also expected to sign a protocol agreement to develop their joint chemical project in Texas, a source close to the matter said.

The White House official said the kingdom was in the final stage of negotiating a $100 billion arms deal.

A New York Stock Exchange delegation is also expected to visit Saudi Arabia after Trump to try to lure a listing by Aramco, slated for 2018 and worth about $100 billion. World stock exchanges are vying for slices of Aramco’s initial public offering, expected to be the largest in history, with Hong Kong currently the front-runner among bourses in Asia because of its strategic links to key Saudi oil importer China.

The NYSE delegation will have tough competition as rival exchanges tweak regulation to become more attractive options.

![President Pezeshkian has denounced Israel's attacks on Lebanon [Getty]](/sites/default/files/styles/image_684x385/public/2173482924.jpeg?h=a5f2f23a&itok=q3evVtko)

Follow the Middle East's top stories in English at The New Arab on Google News

Follow the Middle East's top stories in English at The New Arab on Google News