Lebanon erupts in protest over 'capital controls' law, set to 'benefit the elite'

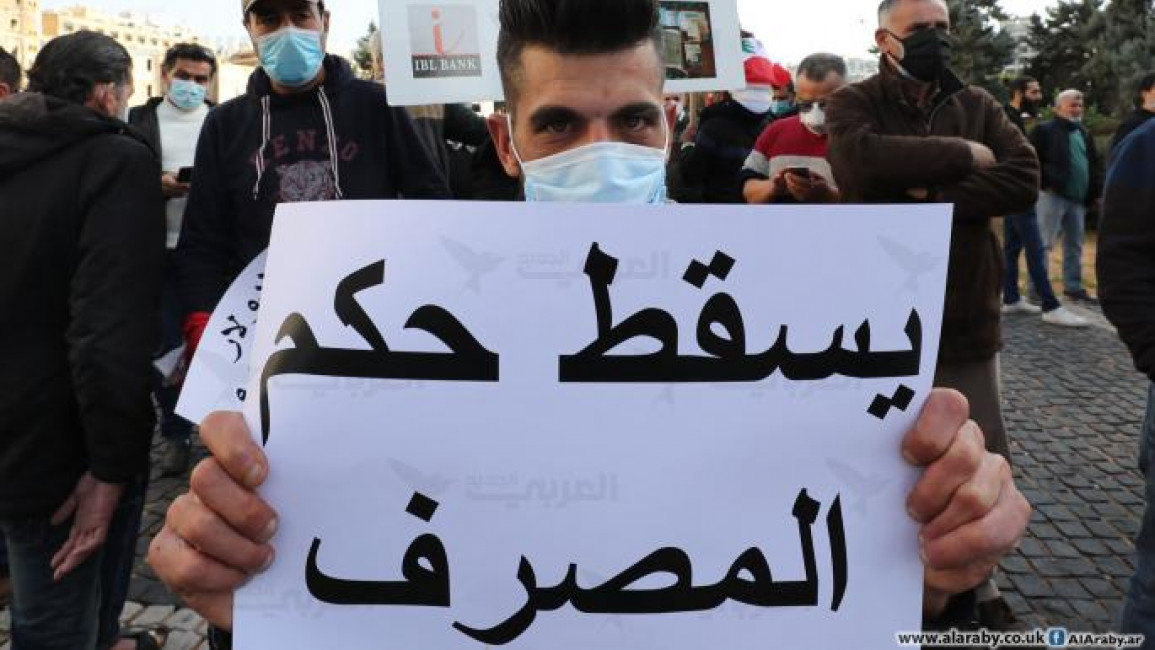

Protests erupted in Lebanon on Tuesday against the approval of a new law on capital controls, as a joint parliamentary session was held to discuss the proposed legislation.

Capital controls are one of the International Monetary Fund's (IMF) key policy recommendations for the Lebanese government with an aid package earmarked by the body for Beirut appearing to hinge on this.

It comes after Lebanon's financial system imploded in 2019, paralyzing the banking system and freezing the bank accounts of most Lebanese.

This economic crisis - one of the biggest in the past two centuries - has led to dire poverty in Lebanon, with prices escalating, savings diminished, and Lebanese unable to access their own money.

Lebanese say the new 'capital control' law will not protect the deposits of ordinary citizens and instead remove accountability for bankers and politicians who they view as responsible for the crisis.

Protestors marched to the Lebanese parliament in downtown Beirut to voice their rejection of the law, which is due to be passed by the cabinet.

"Many claim it fails to protect Lebanese depositors and legitimises violations carried by the banking sector"

The draft law, which was discussed this week in parliament, does not mention depositors' rights and protections and instead grants huge powers to the Lebanese Central Bank's governor.

Lebanese Deputy Prime Minister Saadeh al-Shami announced that amendments include the formation of a committee to determine terms and conditions regarding bank withdrawals in Lebanese pounds and foreign currencies.

It will include representatives from the Central Bank of Lebanon - including the bank's controversial governor, Riad Salameh - the ministry of finance, two economists, and a high-ranking judge.

Prime Minister Najib Mikati stressed that one of the government's priorities when it comes to rebuilding the economy is protecting depositors' rights, although few Lebanese are convinced of these assurances.

"The recovery plan prioritises protecting people's rights, re-activating the productive sectors, and also preserving the banking sector - which forms a fundamental part of any economic recovery," he said during a meeting with a delegation from the Association of Banks in Lebanon (ABL) on Tuesday.

"Everything being said about negligence towards depositors' rights, and about striking the banking sector just aims to stir up confusion and stoke tensions."

Lawyer Dina Abou Zour, a member of the Depositors' Union in Lebanon, told Al-Araby Al-Jadeed, The New Arab's Arabic-language sister publication, that she is concerned about the implications of the new law.

"Any law approved without a genuine, comprehensive and just recovery plan alongside it means what we are facing is a sham law that will legislate and entrench violations of the law and the constitution... and aims to usurp the authority of the judiciary and legitimise flagrant banking violations to benefit those corrupting the state," Abou Zour said.

She also criticsed the planned law's potential to weaken the judiciary, one of the few institutions in Lebanon capable of holding politicians and civil servants to account.

"The crises we face have not gone away, however this law absolves those responsible for the recent period and legalises what they have been doing, attacks equality, the constitution and all the laws"

"The committee, which has been invented is essentially there to hand the country over to the very system which caused the crises, is fundamentally unable to solve them," Abou Zour said.

"Besides this, it includes certain individuals - like the governor of the Central Bank Riad Salameh - who is facing charges both within Lebanon and abroad."

She said the new law would legitimise past abuses by politicians and be an assault on equality, the constitution, and Lebanese law.

"It makes depositors bear the losses and seizes full control over people, their money, their transfers and withdrawals. It should be rejected by any standards if it doesn't undergo radical alterations," she added.

This is an edited translation from our Arabic edition with additional reporting. To read the original article click here.